There has been a general decline in the prices of cryptocurrencies. Amid increasing concerns, Avorak, a new AI project based on the BNB Smart Chain, suggests that understanding why Ethereum (ETH) is going down is key to making money in the bear market.

Ethereum (ETH)

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization. Despite the notable decline of various altcoins following the SEC’s lawsuit against Binance and Coinbase, ETH managed to maintain a relatively stable price. However, a recent mention of Ethereum (ETH) in the SEC case against XRP caused a slight dip in its value. ETH was labeled a “favored” digital currency owing to the recently released Hinman Emails. This is because the SEC deemed Ethereum a non-security, even though it underwent an Initial Coin Offering (ICO) similar to XRP.

The lack of regulatory clarity and the contrasting treatment of Ethereum and XRP has left many investors concerned. And analysts warn that while the decline in Ethereum’s price was minimal, an escalation in fear, uncertainty, and doubt (FUD) could lead to a more significant drop. While it’s true that the cryptocurrency market is highly volatile and predictable, Avorak can help investors with ETH price predictions and more.

Ethereum price prediction with Avorak

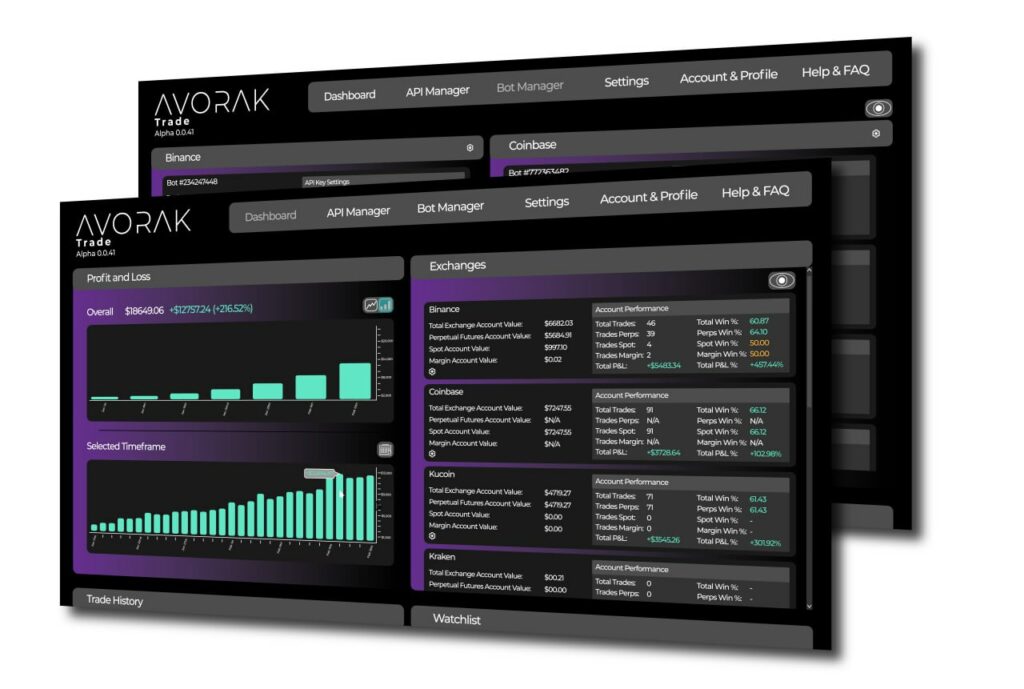

Avorak is committed to streamlining many human-led tasks by providing a wide range of AI-driven solutions. For trading, Avorak offers the Avorak Trade bot.

By leveraging advanced AI algorithms, Avorak Trade thoroughly analyzes vast amounts of historical and real-time market data to identify specific patterns and trends related to Ethereum (ETH). Machine Learning algorithms enable Avorak Trade to continuously refine its predictions, adapt to evolving market conditions, and improve accuracy. This adaptability allows the bot to consider new developments, such as regulatory actions and their impact on Ethereum’s price, thereby providing more precise predictions. Avorak Trade also offers indicators and has integrated notification systems that can alert users when changes in Ethereum’s patterns and trends occur. Traders and investors can leverage Avorak Trade’s insights to make informed decisions regarding buying, selling, or holding Ethereum, gaining a significant advantage in the bear market.

Additionally, Avorak Trade has an API that allows for the automation of trades across different exchanges and assets. Traders can therefore set predefined strategies and let the bot automate the trades, eliminating the risk of human error and ensuring swift and accurate execution. Users don’t have to be experts, as Avorak Trade uses a non-code command-line input, and its algorithms are designed to find the best trades possible. With Avorak Trade, users can optimize their trading strategies, enhance their investment portfolios, and navigate Ethereum’s price fluctuations more efficiently and effectively.

AVRK, the token required to access Avorak Trade, is selling at $0.255 in phase 7 of Avorak’s ICO. Investors at this stage get a 4% on-top bonus and priority access to Avorak’s staking pools and beta products, among other benefits. Analysts suggest that Avorak (AVRK) could surge by a significant magnitude not long after its launch.

Website: https://avorak.ai

Buy AVRK: https://invest.avorak.ai/register