- The operating margin of Southwest Airlines Company is 11.30%.

- The LUV stock price is following a very strong downtrend.

The Southwest Airlines Company founded in the year 1967 and the current CEO of the company is Robert E. Jordan. Southwest Airlines has a unique corporate culture that emphasizes customer service, employee empowerment, and fun. It is known for its low fares, no assigned seats, free checked bags, and humorous flight attendants.

The dividend yield by the Southwest Airlines Company is 0.53 with a payout ratio of 21.44%. The dividend paid on each share by the Southwest Airlines is $0.18 throughout the year 2022. Also the price-to-earnings ratio of the stock is 28.10 which indicates that the investors are ready to pay higher prices for the stock in future.

The current beta of the LUV stock is 1.15 which makes the LUV share particularly more volatile than the overall market. The company has a total of 593.131M shares floating in the market. The LUV stock has an EPS of 0.98 USD which represents the amount of money the company is making on each share.

Strong Red Candles On The Chart Of LUV Stock, What’s Coming Next?

The airline’s stock, LUV has given good returns in the past. It has also advanced by more than 3900% from its IPO price to hitting an all-time high price. The stock hit its all-time high price of $66.99 on 18th December 2017.

Currently, the stock price of LUV stock is consistently declining making lower low structure in the market. The last swing high formed on the chart was on 10th July 2023 hitting a high of $39.53. Since then the share price has declined by more than 35% leading to a steep downtrend.

The 50-day and the 200-day EMA are following a death cross and the share price is declining to lower levels after taking rejection from 50-day EMA. The RSI for the stock is also negative hitting the oversold zones. This indicates the possibility of further decline in the share price.

Financial Performance For LUV Stock

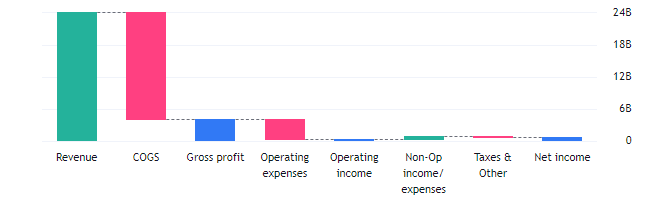

The revenue of the company has advanced by 4.6% in Q2 2023 resulting in $7.04B year-on-year. The gross profit has also advanced by 5.7% but the net income has declined by -10.1% resulting in $683.00M. The incurred operating expenses for the year ending 2022 are $3.735B and the profit margin for the same is 2.26%.

Conclusion

As the airline companies are suffering, the financials of the Southwest Airlines Company do not look promising. The technical indicators are giving a sell signal. The LUV share price is also following a strong downtrend making bearish candles on the charts.

Technical Levels

- Support levels– $14.70 and $22.50

- Resistance levels– $37.50 and $47.00

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.